DEX 93 -- Personal Income Tax Correspondence Sheet. Extension of Two Months for Filing Malaysia Income Tax 2020.

We Are Here To Help You Tax Payroll Accountacy Vat Pahrirl Tax Preparation Tax Services Tax Deductions

In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively.

. Microsoft Windows 81 service pack terkini Linux atau Macintosh. PA-19 -- PA Schedule 19 - Sale of a Principal Residence. How Does Monthly Tax Deduction Work In Malaysia.

Key Malaysian Income Tax Info Do I need to file my income taxYes you would need to file your income tax for this past year if. Country-by-Country Reporting in Malaysia The Income Tax Country-by-Country Reporting Rules 2016 hereinafter referred to as CbCR Rules has been gazetted on 23. The deadline for filing your tax return depends on where your income comes from.

Tax returns must be filed by 30 April of the following year. The scope of income to be taxed covers all classes of income including passive income eg. On the First 5000.

Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower. Our personal income tax Form BBEMMT submission package includes. With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million.

Malaysia has a progressive income tax system which means the more you earn the more you will need to pay. The new deadline for filing income tax returns in Malaysia is now 30. Refer to the important filingfurnishing dates section for further information.

The current CIT rates are provided in the following table. For a person carrying on a business the tax filing deadline is 30 June 2017. Personal income tax in Malaysia is charged at a progressive rate between 0 28.

The MIRB had released sample notification letters for the. On the First 5000 Next 15000. For individuals who derive business income the filing deadline is 30 June of the following year.

Corporate - Other issues. 50 income tax exemption on rental income of residential homes. The law also changed due dates for taxpayers with foreign assets.

DFO-02 -- Personal Individual Tax Preparation Guide - For Personal Income Tax Returns PA-40. Guide To Using LHDN e-Filing To File Your Income Tax. 4 Check those details.

The Government has announced an extension of two months for filing income tax from the original deadline in consideration of the Movement Restriction Order MRO that has been enforced during the COVID-19 pandemic. Very long guideline of procedure is published and go thru standard guideline maybe taken time. 2017 Personal Income Tax Forms.

Similarly those with a chargeable. The YA runs from 1 January to 31 December. PwC 20162017 Malaysian Tax Booklet Income Tax 2 Returns assessments Taxpayers are required to submit their income tax returns to the Inland Revenue Board IRB within the prescribed timeframe.

A tax return submitted by the prescribed due date is. 12 rows Income tax rate Malaysia 2018 vs 2017. Filing Malaysia income tax 2016 with quick Guideline Filling Income tax 2016 with Quick Guidelines.

Useful reference information on Malaysian Income Tax 2017 for year of assessment 2016 for resident individuals. Yearly income tax relief will not be same each year. Calculations RM Rate TaxRM A.

Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. How To Pay Your Income Tax In Malaysia. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

Do keep in mind that youre filing for 2016 income tax in 2017. A new law which kicks in for the tax year 2016 has flipped due dates for some corporate and partnership tax returns due in 2017. Year ending 31 December 2017 and the notification deadline would be on or before 31 December 2017.

Employees whose total income tax is equivalent to the total amount of Monthly Tax Deduction MTD is no longer required to submit tax returns. Given one or two month plus to filling income tax. The tax filing deadline for person not carrying on a business is by 30 April 2017.

Remember to file your income tax before the deadline of 30 th April 2016. PA-1 -- Online Use Tax Return. Dimaklumkan bahawa pembayar cukai yang pertama kali.

KUALA LUMPUR Oct 24 The deadline for the submission of income tax return forms BNCP for the assessment years of 2019 and 2020 for companies cooperative societies limited liability partnerships trust bodies and petroleum remains as stipulated in the Return Form Filing Programme for the year 2020 Amendment 32020. Dividends interest royalties etc There will however be a transitional period from 1 January 2022 to 30 June 2022 where foreign-sourced income remitted to Malaysia will be taxed at the rate of 3 on gross income. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

PA-40 -- 2017 Pennsylvania Income Tax Return. The Malaysian tax year runs from January 1st - December 31st. However if you derive income from employment then you have to file your taxes before April 30th.

For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. According to the. The Complete Malaysia Personal Income Tax Guide 2018 YA 2017 INFOGRAPHIC Last updated Apr 02 2019.

If youre self-employed for instance then the deadline is June 30th. Tax Offences And Penalties In Malaysia. The deadlines a few weeks away so dont dilly dally.

Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis. Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5. Always focus with routine work or own business.

Inland Revenue Board of Malaysia IRB charges 10 increment on the tax payable for late filing and additional 5 on the balance if the payment is not made after 60 days from the final date.

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

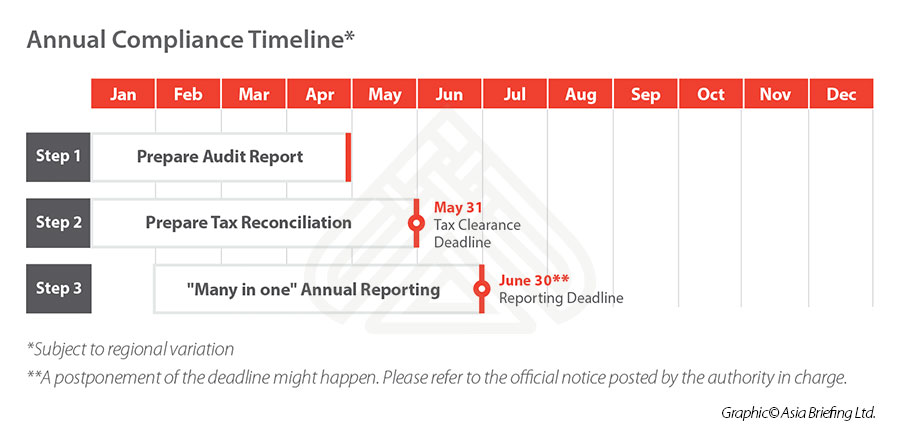

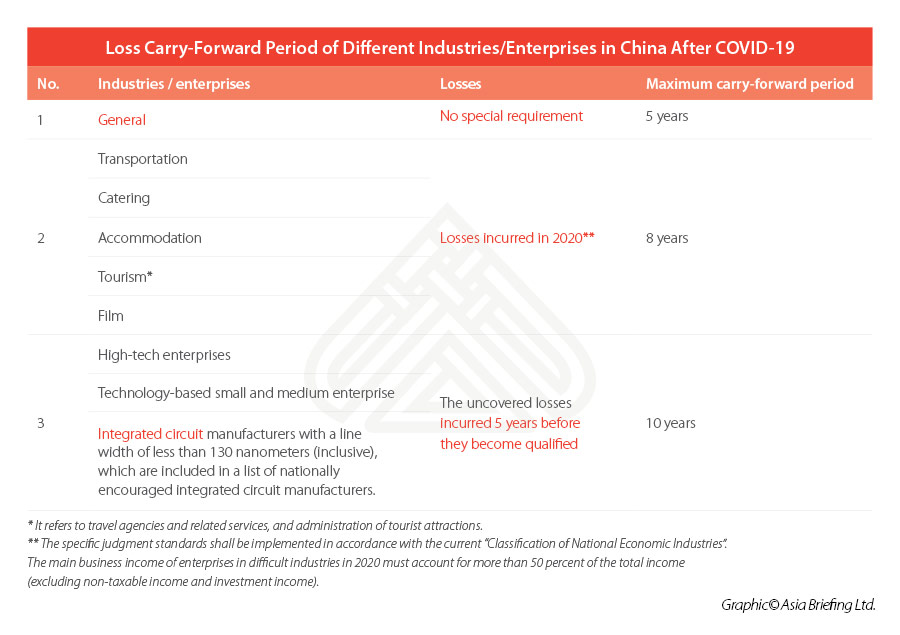

Preparing For Annual Tax Reconciliation In China In 2021 Faqs

10 Quick Facts About The Upcoming Tax Season That You Need To Know

Rates For Regular Gym Memberships At Miracles Fitness At The Garage Ocean View Gym Membership Fitness Membership Garage Gym

Timely Filing The Feie Form 2555 Expat Tax Professionals

7 Things To Do Right Now To Save On Taxes This Year

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Preparing For Annual Tax Reconciliation In China In 2021 Faqs

You Made A Mistake On Your Tax Return Now What

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Flowchart Final Income Tax Download Scientific Diagram

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Tax Time The Costs To Keep In Mind While Hiring An Accountant

𝗧𝗮𝘅 𝗳𝗶𝗹𝗶𝗻𝗴 𝗗𝗲𝗮𝗱𝗹𝗶𝗻𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟭 Ks Chia Associates Facebook

Business Income Tax Malaysia Deadlines For 2021